All About Financial Advisor Brisbane

Table of ContentsSome Ideas on Financial Advisor Brisbane You Should KnowThe 3-Minute Rule for Financial Advisor BrisbaneThe smart Trick of Financial Advisor Brisbane That Nobody is Talking AboutLittle Known Questions About Financial Advisor Brisbane.Financial Advisor Brisbane Can Be Fun For Everyone

Financial planners aren't simply for the well-off. They can help those of more small means to figure out a means to money their youngsters's university education and learnings, to intend for retired life, or to see to it that their internal revenue service bills are as manageable as possible. They can aid you spend carefully if you have some cash left over after seeing to these problems.It can include: Aid with one monetary concern, for instance, how much to add to your super, or what to do if you acquire shares. Help to create a financial plan to reach your financial objectives. This covers points like cost savings, investments, insurance coverage and incredibly and retired life preparation. Normal monitoring and review of your financial strategy and events.

As soon as you recognize what you desire, discover a consultant who uses the right solutions for you. Financial Advisor Brisbane. You can locate a qualified monetary advisor through: an economic advice professional organization your extremely fund your lending institution or banks recommendations from individuals you understand Search by postal code on the monetary advisers sign up to discover a certified consultant near you

An Unbiased View of Financial Advisor Brisbane

The best way to see what a monetary consultant offers is to read their Financial Provider Overview (FSG). Look for this info on their site or ask them for a duplicate.

Robo-advice could be cheaper and much more hassle-free than a financial adviser, yet it has limitations. It can't address your questions, and it can't provide you guidance regarding intricate monetary situations.

This makes it easy to satisfy with a couple of various consultants to compare what they supply.

See This Report about Financial Advisor Brisbane

Read on to recognize extra. An economic consultant is an experienced professional specialising in economic preparation, investments, and wealth management, possessing characteristics such as strong logical abilities, outstanding communication, in-depth economic knowledge, ethical conduct, a client-centric method, adaptability to market adjustments, governing compliance, analytic ability, strategic preparation ability, and a continuous knowing state of mind.

The obligations of an economic consultant incorporate a wide range of financial solutions and customer requirements. The role of an economic consultant is to give customised monetary advice.

Beneficiary Designations: They make sure that recipient classifications on retirement accounts, insurance plan, and other assets line up with this post the customer's estate strategy. Reducing Probate: Advisors aid customers structure their estates to reduce the influence of probate court proceedings and connected expenses. The advantages of a financial consultant reach retired life preparation and income administration.

Not known Facts About Financial Advisor Brisbane

In our interconnected globe, monetary consultants may need to think about worldwide investments, tax implications, and estate planning for customers with international properties or passions (Financial Advisor Brisbane). Remaining notified about international economic markets and laws will certainly be essential. Welcoming digital systems and devices for customer communications, profile management, and financial planning is becoming important

Selecting a fiduciary consultant can supply additional confidence that their referrals are in your favour. Request references from present or previous clients to obtain a feeling of the consultant's performance and client contentment.

To navigate the intricacies of the financial world you can reach out to Share India. Yes, a lot of monetary experts need to be licensed and might hold qualifications Yes, financial experts can provide support on handling and lowering debt as component of a thorough monetary strategy. Numerous financial experts supply tax preparation suggestions as part of their solutions, assisting customers optimise their finances while minimising tax obligation obligations.

8 Easy Facts About Financial Advisor Brisbane Explained

The timeline for Australian economic solutions (AFS) licensees and economic advisers to comply with the professional standards is embeded in the Firms Act. Of what to do by when, additional reading see Timeline for the reforms. On 28 October 2021, the Financial Industry Reform (Hayne Royal Commission Reaction Better Suggestions) Act 2021 (Better Guidance Act) transferred features associating with the reforms from the Financial Consultant Standards and Ethics Authority (FASEA) to the Priest and to ASIC.

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Tia Carrere Then & Now!

Tia Carrere Then & Now! Alexa Vega Then & Now!

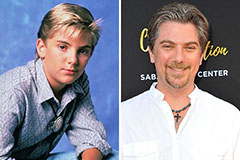

Alexa Vega Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Jeri Ryan Then & Now!

Jeri Ryan Then & Now!